If at the beginning of the year we’d been told all that was going to happen in the world economy and the behaviour of the stock market, we couldn’t have imagined that we were going to be where we are today.

Of course, no one could’ve predicted that in a matter of months we would be plunged into a global pandemic with all its economic and social effects. The COVID-19 crisis is more or less affecting all countries in the world. However, looking at the stock market, it’s surprising that we’ve experienced the largest consecutive decline and recovery of any of the last ten bear markets.

The market has long been looking like a giant maintained and subsidised by the central banks, which get involved in the markets when faced with any problems, causing a complete disconnection from the economy, and from any traditional valuation metrics.

In June, the Nasdaq became the first major Wall Street index to recoup its coronavirus-induced losses, reaching historical levels every day over the next few months. The S&P 500 hit highs in early September. But so far, we’ve only talked about indices. Are indices the reality of the stock market?

Definitely not. Indices are a set of stocks that have weightings determined based on the number of shares in circulation and the price. In other words, depending on their size, their market cap1.

These weightings are currently very distorted. The pandemic has led to the technology and health sectors accounting for more than 50% of the S&P 500 market cap for the first time in history. More specifically, technology companies have doubled their weighting over the last five years, accounting for 25% of the index. Moreover, among the 100 largest companies in the S&P 500, the five largest by market cap represent 33%, which is a remarkable figure. This has caused major stock market indices to hit all-time highs even though a large number of underlying stocks are recovering very slowly, and in fact these gains are only the result of improved performances by larger companies.

We can assume that the largest companies are essentially the most solid, but the truth is that the way to get returns in the long term is not to invest in those companies that are seen as winners at any price. It has been proven that the way to do this in the long run is to have a concentrated portfolio of stocks where the market seems to have an overly pessimistic view of their fundamentals, but that really are much better than they appear.

However, there are periods in which the market seems to be trying to divide the companies into two types: the good and the bad. Where “good shares” have already increased in value, their valuations are expensive, but they seem unaffected by price, and never reach a high enough level. On the contrary, “bad ones” are shares that are already cheap, which have also undergone a correction, but no price is low enough for these companies, as they are becoming increasingly disconnected from their intrinsic value.

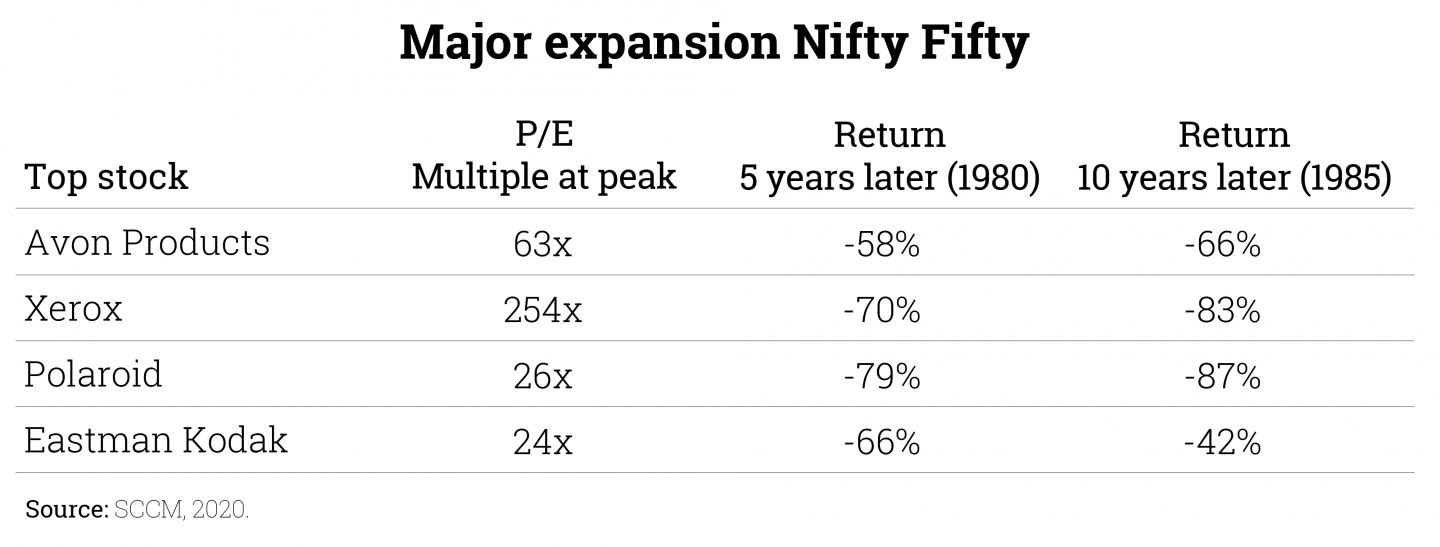

The Nifty Fifty

The Nifty Fifty bubble is essential to understanding this situation. Between 1960 and 1973, this was the name given to a group of 50 shares on the New York Stock Exchange characterised by their rapid growth and high valuations, which constantly seemed to be irrelevant. It was a time as well as a boom for investment funds in the United States, as almost everyone invested in these very solid stocks and this thereby fuelled the bubble. However, their high valuations ended up making them vulnerable and the bubble burst, leading to strong sales and the consequent low relative performance during the 1980s.

The lesson to be learned is that the strength of the stock, despite being very important, is not enough, because its valuation is more important. Investors should always be aware of the initial valuation, with a few exceptions. Valuations will at some point fall back to more reasonable levels, almost always at the expense of poor performance in the medium term.

This doesn’t mean that companies are starting to become bad businesses, but simply that they’re no longer good investment ideas. Why is that? Because the shares are still worth the present value of their future cash flows. When a company’s share price is no longer justified by its fundamentals and begins to react to factors that don’t reflect the reality of business, this leads to an overpricing due to the discrepancy between its expectations and fundamentals, which sooner or later will end up converging.

Skewing investment decisions with a short-term forecast based on monitoring a trend, without considering the implicit risk of overpaying for the stock, is never a good idea. It’s important to have a strict discipline in decision-making that allows us to escape the noise. In the words of Benjamin Graham, “In the short run, the market is a voting machine, but in the long run it is a weighing machine”. In other words, avoid the part where the market behaves like a voting machine by trying to identify what the majority votes and follow it, because in the long term it is a weighing machine, where the resilience of companies prevails.

When the euphoria and narrative that dominate the current environment subside, cheap companies, at a significant discount on their intrinsic value, have the potential not only to limit downside risk by not carrying such aggressive expectations, but also to provide extraordinary returns when the market comes to its senses and fundamentals prevail.

1 Most indices are weighted by market cap, although there are exceptions such as the Dow Jones Industrial or Nikkei 225 indices, which are calculated by weighting their components by price.

Did you find this useful?

- |