Sometimes we are presented with the dilemma of choosing one or another way of achieving profitability in a manner that I do not consider optimal: Why shouldn’t I earn more by buying a few stocks directly on the market than by investing through a fund if I can save the management and deposit fees?

Here, once again, we should differentiate between: Am I a better stock picker than the best manager available? After all the expenses and taxes, what real savings do I have by investing directly?

Let’s take it one step at a time. I think that the discussion on profitability becomes clearer if it is broken down as follows:

1. Will I be able to consistently beat my benchmark index, including dividends, and after all expenses and taxes have been deducted?

2. Is there a manager available who will consistently beat my benchmark index and, again, after all expenses and taxes have been deducted?

In other words, the choice of the form of investment – direct or indirect – must take into account my capacity and that of the best available manager.

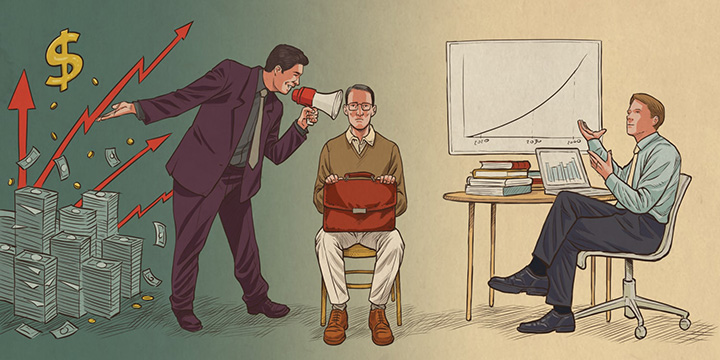

Let’s address the first point. What makes me think I’m going to outsmart the market as a whole, and do so systematically? I am not saying that isn’t possible, but think for a moment of that famous – and real – example where most drivers thought they were driving better than average. Which is impossible, of course. The market reflects all the buying and selling decisions of all the participants. And it’s not easy to beat it, especially in the long run.

Second point. There is a way of investing known as value investing that has proven itself capable of beating the market systematically. You can try to apply this on your own. It is not impossible, but it is difficult, and it requires a lot of work, experience, knowledge and especially strong stamina and independence of judgment: you often have to go against the market consensus. And if you’re unable to have your own analysis of sufficient quality, along with sufficient accounting knowledge, the damage can be considerable.

There are also cost benefits in collective investment. Not everything is a drawback like fees. With a larger volume of operations, you get better rates with brokers. In addition, tax deferral – delaying the payment of taxes – is a very big benefit (see Appendix at the end on taxes and profitability). So is the possibility of making transfers between funds.

Another advantage of collective investment is that, with a modest investment, great diversification is achieved naturally. Imagine you can only invest 1,000 euros. It would seem more prudent and logical to channel investment through a mutual fund or a pension plan.

Another reason to prefer collective investment, from a value investing point of view, is that Warren Buffett recommends investing only when the opportunity arises. Imagine you just inherited a million euros. What would you do? Well, surely, the first thing would be to pay off debts, get a new car maybe, fix your house and take that trip you’ve always dreamed of. If you have money left, as I hope you do, how do you invest it in an optimal way? There’s no answer to that. Remember that optimal means unbeatable. Instead of looking for what is optimal, it’s often best to settle for prudence and avoid the biggest risks. After all, the future is not written.

DCA

A rational and proven way of investing is the system known as dollar cost averaging, or DCA. Simply put, it consists of periodically investing constant monetary amounts. In this way, market fluctuations play in your favour allowing you to buy more (shares, for example) when the market is at its lowest and to buy less when the market is at its highest. This lowers the average cost and thus increases profitability.

Another advantage of investing systematically is that you automate the process. Hence, it is less influenced by your state of mind, which can often play tricks on you. For example, you know that it is essential to buy low; this can easily lead us to the idea – which is almost always wrong – that it is feasible to buy at rock bottom. And rock bottom almost always becomes clear only after the fact. So, you might be putting off the time to buy hoping to be able to buy at the optimal time, which is quite difficult. You shouldn’t look for the optimal time because that’s usually a mirage. When the price is right, you have to buy. It might keep going down, but maybe it won’t. You cannot know this a priori, but there is a risk of not investing because you’re looking for the optimal time, and that is too big an opportunity cost.

I would also like to emphasise that the investor should be focused on the investment process, not on the results. That is, focus what you can control, not on what you cannot control.

Going back to the DCA, let’s use a small numerical example to illustrate its how valuable it is. Imagine you invest 1,000 euros a month in buying shares of company A and you have the process automated. On the first buying date, A’s shares are listed at 5 euros each. So you buy 200 shares. After a month, let’s assume that the share is listed at 10 euros. So you buy 100 shares. In total, you’ve bought 300 shares at a cost of 2,000 euros. The resulting average price is 2,000/300=6.67 euros per share. This price is closer to the minimum (5) than the maximum (10). You’ve achieved your goal, which was to buy low.

It is easier to implement a DCA strategy on funds than on shares for several reasons:

- Units in a fund are divisible, unlike shares. This allows for more finely-tuned management of the DCA approach (if the shares in the example above are listed at 30 euros, you will not be able to invest exactly 1,000 euros).

- It’s more intuitive. By investing in shares, you could invent a variation: buy the same amount of shares each month. This strategy does not allow for reducing the average buying price derived from the DCA.

- Lastly, although this is no longer always the case, systematic fund (or pension plan) purchases can be scheduled on almost any platform. In stocks, the same options are not always available.

I would reiterate that the automation of investment processes is key. The fewer decisions you make, the better, because you have fewer opportunities for error. This is also counterintuitive, no doubt.

Also, we should get used to not checking the value of our portfolio too often. For several reasons. Even with the best of investments, the value drops almost half the time. It has been proven by experimental psychology that the pain caused by a loss is at least twice as great as the pleasure we derive from a gain. That’s right, we’re “programmed” to avoid loss and pain. How can we overcome our natural tendency to make too many financial decisions? A smart investor is a knowledgeable investor. They do their homework and, before investing, achieve certainty regarding the soundness of the investment by studying the factors that make an investment sound. They analyse the stock they are going to buy or study carefully the investment system of the fund manager they are planning to subscribe to. Periodically, such as every three months, they review their position and read the managers’ reports. If they remain just as certain, they can either maintain or increase the investment. If they are not, they should consider moving the fund in question.

An investor who often changes their investment vehicle is rarely a successful investor. Rather, they search for a fund whose philosophy: they know, understand and share

They invest for the long term, preferably through periodic contributions of the same amount. They are patient and are focused more on the process than on the results.

We mentioned, in passing, the importance of focusing on the investment process and not on the results. It is logical to focus all your effort and attention on what you can control, not on what you cannot control.

Looking for results can lead to mistaken decisions. It’s a bit like buying because an asset has gone up. You don’t know if it’s going to keep going up, but you’re dazzled by the rise. Something similar also holds true for a manager’s results. To be relevant, you should take a period of at least five years.

Also, when selecting a fund, you should look at all the fees and commissions and the TER (total expense ratio).

The investor’s first rule should be not to invest in something that is not known. One is often tempted by the “promise” of quick and easy returns. Which means: don’t worry about a thing, you send us the money and we’ll take care of all the rest. From trading to derivatives. From forex to the most obscure businesses. I repeat: if someone offers you a quick and easy way to get rich, be wary. Have them give a good explanation of everything. If doubts persist, better steer clear. Remember, there are no magic formulas. If someone had one, why would they want to share it with other people?

In this boggy terrain we are entering, we must start by ruling out anything that might reek of fraud: financial schemes, non-regulated and opaque operations.

Value investing basically requires the following: knowledge, independent judgment and patience

Generally, there is no optimal moment to invest. If you are looking for the market low, you’ll only know it when it has already happened. So, an investor should invest when the price is right. No one knows if it will go up or down. There is a well-known paradox among value investors:

Let’s imagine that we value certain stock, say the company XXX, at 10 euros. It is often recommended that the safety margin should be at least 20%; that is, in this case, you would buy the share if it was trading at 8 euros or less. Now this stock was trading at 9 euros and now it’s down to 8 euros. Should you buy? The theory says yes – unless, of course, you have better investment alternatives. So, you buy a share package at 8 euros, say 12,000 euros. We are now the happy owners of 12,000 x 8 = 1,500 shares of company XXX. Let us remember that, according to our valuation, these shares are worth more: 1,500 x 10 = 15,000 euros. So, you have an unrealised gain of 3,000 (15,000 – 12,000), provided that your valuation is correct. Now a month goes by and XXX shares are trading at 6 euros. What should you do? Let’s illustrate the difference between price and value. Our shares bought at 8 euros now cost 1,500 x 6 = 9,000 euros. It seems, then, that the business is not going too well for you. You’ve invested 12,000 euros and right now the market values our package of shares at 3,000 euros less. If this is the portfolio of a mutual fund, this has to be reflected in its net asset value: the fund goes down in value.

However, what a good value investor must do in this case is to recalculate their valuation of the XXX share. In our simplified example, the estimated value is still 10 euros a share. Now – and this is where the actions of a value investor most sharply differ from that of most other investors – you should buy more shares at 6 euros, as they are now very cheap. So we spend another 12,000 euros to buy 12,000/6 = 2,000 more shares. We now have 1,500 + 2,000 = 3,500 shares, which have cost us a total of 24,000 euros, but which we value at 3,500 x 10 = 35,000 euros, with an estimated capital gain of 11,000 euros (almost 50% of the total investment).

Short term market movements are unpredictable. In the long term, however, price and value tend to converge. Therefore, if our analysis is correct, the shares of company XXX will tend to be worth 10 euros. This would appear to be an ideal case, but this is what value managers and investors usually do. They concentrate on what’s important (their valuation) and not on what’s secondary (following the daily share prices). This is how, as Benjamin Graham said, they use the market and do not become its servants. Obviously, in this whole process, independence of judgment is crucial: self-confidence, not being driven by market sentiment or what most investors do.

It should be noted that the market often overreacts to news, whether good or bad. This gives rise to opportunities to buy – when the market is scared – or to sell – when it is euphoric. And this is something the smart investor can take advantage of.

Let’s conclude with a brief discussion of how to put into practice what we’ve talked about. For a non-professional investor, the most prudent approach and, I believe, the profitable one, is to invest the majority of their assets through well-selected mutual funds and pension plans. It is best to apply the DCA for years – even better, decades – and let compound interest do its work. This investment core can be supplemented with some very select shares. When the opportunity is very clear, you have to take it, and you can make a lot of money that way.

Our goal as a long-term investor is not only to make a lot of money, but also to reach the finish line alive. If you take too much risk because you’re dazzled by the possibility of huge returns, you can wake up one day shirtless.

Appendix 1. Compound interest. We have hardly talked about it, but this is the engine of long-term returns. There is the rule of 72, which is approximate. For example, if your investment returns a cumulative 10% annually – that is, all returns are reinvested -, in 72/10 = approx. 7 years you have doubled the value of your investment. But it doesn’t end there. Now here’s the best part:

In 7 years, it doubles

In 14 years, it multiplies by 4

In 21 years, it multiplies by 8

In 28 years, it multiplies by 16

In 35 years, it multiplies by 32

Etc.

It pays to be patient, because the rewards are huge.

http://www.moneychimp.com/calculator/compound_interest_calculator.htm

The money chimp calculator can help you make investment simulations. Use it, it’s very useful.

Appendix 2. Tax and compound interest. Now you know that it is in your interest to make your investment benefit from compound interest. No less important is the effect of taxes on the return from an investment. You have to try to minimise taxes and defer them as much as possible (the later the better).

It is easy to see that, for example, an investment that yields 15% per year and is taxed annually, assuming a 20% tax on capital gains, is financially equivalent to a 12% non-taxable one.

r = i (1-t)

r = 0.15 * (0.8) = 0.12 = 12%

assuming other figures:

if i = 20% and t = 25%

r will be 0.20 * (1.25) = 0.25 = 25%; the tax effect forces me to get a gross return of 25% to get a net return of 20%

Appendix 3. Diversification. I mentioned that investing through funds (or plans) provides quite considerable diversification. And I said that this is good. Diversification improves the risk-return profile of most investment portfolios. As with almost everything in the world of investment, there are no fixed rules. On the one hand, extreme diversification could mean replicating the market. In that case, it would be advisable to buy the market through a fund or ETF with very low fees and physical replication. If that’s not what you’re looking for, you can buy a set of mutual funds. Because Spanish funds have, by law, limits on the concentration of their portfolios, they have to buy different securities. Some well-known value investors such as Charlie Munger have publicly criticized investment diversification, saying that rather than investing a single dollar in their 20th best investment idea, they would rather invest it in their top five investment ideas. This makes a lot of sense, in principle. However, investing is an exercise in probability: you believe your investment will be successful, but you cannot be completely sure of it. Therefore, it is not unreasonable to diversify your portfolio to try to minimise losses. Always, of course, seeking to keep the odds in your favour. As the Indian American investor Mohnish Pabrai says, heads: you gain a lot; tails: you lose little.

Appendix 4. Results. We already know that the result of an investment is a matter of probability: there is no certainty, only belief. In other words, we can hardly ever be 100% sure that an investment will be profitable. What we have to do is do everything in our power to ensure that the result is favourable (as favourable as possible, with the highest possible probability). At this point, a little formalisation can help clarify ideas. Let’s imagine that the result of an investment is expressed by a simple formula such as:

R(I) = a * B + b * P

Where R(I) would be the result of the investment

B: expected return

P: loss if the investment goes bad (obviously, P<0)

a and b: are the respective subjective probabilities estimated for B and P, respectively.

By construction: a + b = 1 (we are working with numbers multiplied by one, for the sake of simplicity)

We’re not going to calculate anything with our makeshift formula, but we only want to highlight the variables that affect the expected return of an investment: just as important as knowing how much you can gain is knowing how much you can lose, and also making an honest estimate of the odds of each event. It doesn’t do you much good to have a huge positive result if the probability of it happening is negligible (for example, winning the Euromillion jackpot). It’s what’s known as mathematically expected returns.

Appendix 5. A Talebian comment. Which is better: being right or being lucky? If investing is a recurring game, I think the right answer is to be right. You can do your homework well and still not be lucky and lose money. Conversely, a fool can be very lucky and earn a lot of money, without deserving it. However, the fool will not be able to repeat his success; and the smart investor will have other opportunities to make money – as long as he is “alive”, of course. In the long term, the effect of random chance tends to cancel itself out, but not in the short term. Besides, chance or luck is not manageable, and we should focus on what we can manage. So, it’s process, process, process.

(Talebian: that which is related to Nassim N. Taleb https://es.wikipedia.org/wiki/Nassim_Taleb)

Did you find this useful?

- |