A lot of investors are familiar with Benjamin Graham – the father of security analysis and Warren Buffett’s mentor and first employer. Benjamin Graham popularised a style of investing called value investing. Its basic premise is that if you buy an asset at a discount to a conservative estimate of its value, you are likely to make good returns.

Paul Graham, no relation, is a distant ideological cousin of Benjamin Graham’s style of investing. Unfamiliar to most in the value investing universe, he is a programmer and co-founder of Y-Combinator, a technology start-up seed investor. In the strict sense of the word, Paul Graham is also a “value” investor in that he invests in companies at a discount to a conservative estimate of their value.

The difference between the Benjamin Graham’s and Paul Graham’s style of investing is purely a difference of how one views time. The Benjamin Graham estimation of value is roughly what the company is worth today while Paul Graham focuses on value far into the future. Why would something be worth far more in the future compared to today? Growth.

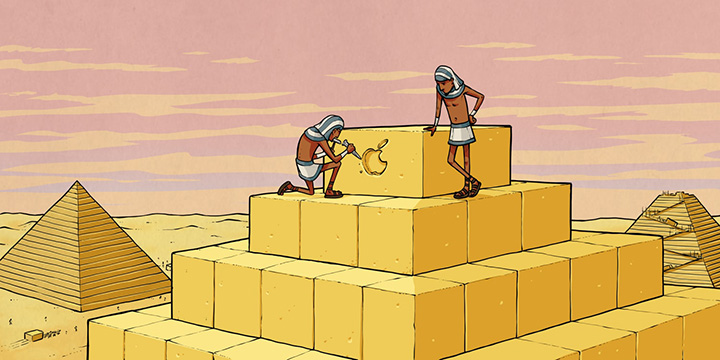

Paul Graham invests in technology companies. Most traditional value investors do not. But what is technology really? It is simply a technique, a way of doing something that is not apparent to everyone else at the time. No magic involved. Egypt in 3000 B.C, the pyramid’s architects, and builders, if incorporated, would have been the tech companies of the day. In Florence in the 1200s, it would have been companies that made fine woven cloth. In the 1600s in the Netherlands, the tech companies would have been shipbuilders and companies developing navigation techniques. In the 1900s in America, it was Carnegie’s steel mills and Rockefeller’s oil refineries.

What do these historical examples of “tech” companies have in common? Rapid growth. This pace of growth is not intuitive and therefore, often undervalued. Human brains are wired to think linearly, not exponentially.

A good “growth” investor understands “s” curves, which depict the typical trajectory of growth companies. It begins with stasis, followed by rapid growth, followed by stasis again once the upper limits of growth are reached. The value in a growth company is naturally its growth phase. This growth phase depends on the slope of the curve i.e. how fast the company is growing, and the length of the curve i.e. how long it can sustain such growth.

False positives and false negatives

Both value and growth investors have a test for spotting value and growth investment opportunities. But like any test, it can be flawed. More specifically, it can be flawed in two distinct ways – through false positives and false negatives.

For a value investor, false positives are the value traps – things that looks cheap based on statistical measures but are actually very expensive because the underlying asset is not worth what is stated in the accounts. False negatives are the missed value opportunities because, again, they look expensive based on traditional metrics of value, so the value investor stays away. Both of these are very expensive mistakes.

A good value investor will swerve through the carnage of most value traps because they understand the real economic value of a company, not its accounting estimate that is stated as the book value on the balance sheet.

For the growth investor, the false positives are the growth traps – companies that are poised to grow fast but simply fail to do so. These are usually companies in fast growing industries. However, a good growth investor can separate the wheat from the chaff.

During the gold rush, people selling shovels did much better than the gold prospectors. During the railroad boom in America, the rails were made by Carnegie’s steel mills. Rockefeller’s Standard Oil used the railroads to get oil to the East Coast, where it could be shipped to Europe. These were the big winners of the railroad boom, not the railroad operators themselves. Good growth investors have a good understanding of competitive dynamics and understand that often, it is the early-adopter marginal players supporting a fast-growing industry that generate most of the wealth.

There are nuggets of truth in both the Benjamin Graham and Paul Graham approaches. The thing that kills most investor returns is dogma. For the value investor, the dogma is that cheapness, regardless of quality, is always good. For the growth investor, the dogma is that growth is always good regardless of the competitive dynamics which dictate how sustainable that growth is.

Did you find this useful?

- |